Good news today as the unemployment rate dropped to 7%. Fears of a taper have been silenced… at least for today… as the S&P has jumped back above 1800. Calculated Risk has provided a great run down of the employment report from this morning.

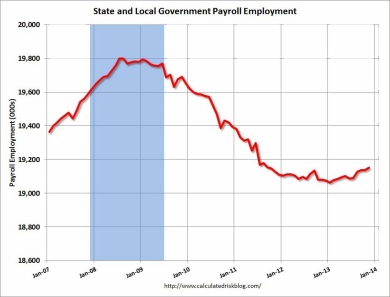

What I believe to be the greatest influence moving forward is “the end of austerity” at the state and local government level. It appears that state and local government employment has finally bottomed and is beginning an uptrend.

Usually government jobs have increased during a recovery, but that wasn’t the case in 2009 (illustrated here). The result in the past was an extra level of protection for the economy in the wake of a recession and a quicker recovery. If governments begin to hire at a more normal pace while private sector hiring continues to build, we could finally witness the kind of recovery expected after a normal recession.

Here are a few good reads to close out your week. I hope you have a great weekend:

- Everything is Amazing and Nobody is Happy (Motley Fool)

- How a few experts feel about this market (CNN)

- Elon Musk makes bank, bro (Time)